ENHANCED PRIVATE INDEXING FOR AFFLUENT INVESTORS OVER $1 MILLION

Tailored Equity Portfolios with Proven Results

Why Earnings Focused Indexing Outperforms the Market

After years of research, the team here at Linden Thomas & Co. concluded that there are three significant aspects of an equity portfolio that drive positive investor outcomes: earnings quality, direct ownership, and cost.

- Earnings quality – owning companies with high historical earnings quality not only aids in enhancing long-term growth, but may also improve down market recovery due to a "flight to quality" dynamic.

- Direct ownership of holdings – investors own and control each stock, which means that they can add shares over time while building wealth. This also provides investors with the ability to gift shares while enhancing tax efficiency through tax loss harvesting.

- Minimizing cost to investors – by managing the portfolio directly, we limit the impact of high advisor fees, as well as the hidden, seldom disclosed trading costs of mutual funds and ETFs.

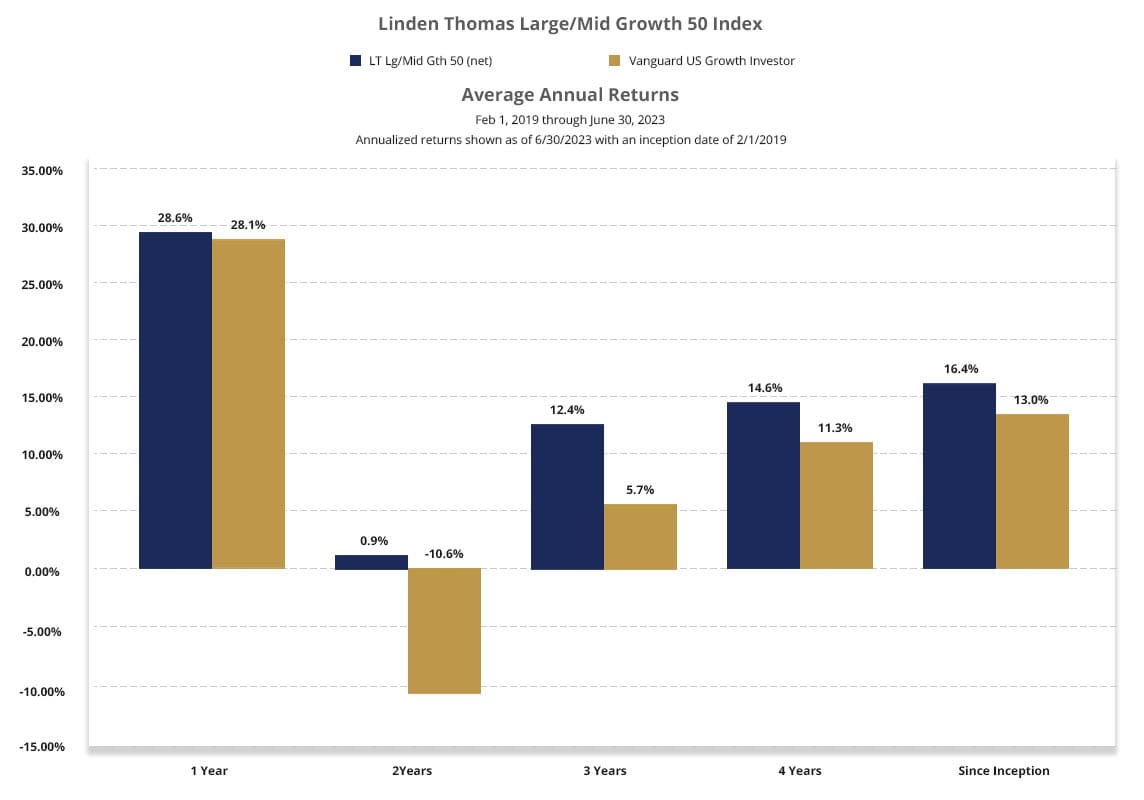

The performance results shown are those of a proprietary account at Linden Thomas invested using real dollars based upon the application of Linden Thomas's Proprietary Linden Thomas Large/Mid Growth 50 Index. These performance results are presented net of a .85% advisory fee. The performance results do not reflect the deduction of other fees or expenses, including but not limited to brokerage fees, custodial fees, fees and expenses charged by mutual funds and other investment companies, and any other fee or expenses a client may incur in the management of such client's investment advisory account. A client's return with respect to an investment would be reduced by any fees or expenses a client may incur in the management of its investment advisory account. The performance results are unaudited and are not an estimate of any specific investors actual performance, which may be materially different from such performance depending on numerous factors. No representations or warranties whatsoever are made by Linden Thomas or any other person or entity as to the future profitability of an investment account or the results of making an investment. Past performance is not a guarantee of future results.

Why Affluent Investors Choose Institutional Direct Asset Management

How do Linden Thomas & Co. and their institutional direct portfolios differ from traditional investment firms and their investment advisors?

- We use earnings screens to identify the companies that consistently meet our high historical earnings standards.

- Direct ownership of holdings provides our clients with not only total transparency, but also control.

- We have no hidden fund fees or trading costs.

- We have no high advisor fees. The simple cost on our earnings-focused equity strategies includes advice, the management fee, and the trading cost of equities.

- Each portfolio is tailored efficiently to each client's income, risk, and long-term growth needs.

- Our goal is to build a portfolio of high-quality equities and bonds that have proven to meet historically proven quality standards.

- Because we build each fixed income portfolio directly, our clients aren't faced with the hidden pricing disadvantages often found in bond funds and ETFs.

- By spreading risk between stock sectors, we avoid over-concentration in our portfolios.

- Down market behavior and chasing hot sectors can often kill results. Owning the best companies reduces the need to be reactive. Our firm spends a lot of time educating our clients, so they understand that with the right portfolio tailored to their needs they never need to overreact to market volatility.

- Every portfolio is built and tailored to each client's specific needs, from the kind of bonds and yields they need, to the individual equities they own.

Traditional investment advisors charge an annual fee for advice, then invest client funds in an allocation of funds or model portfolios where third parties seldom have a direct relationship with the individual investor. When third parties manage money and have no direct relationship with the investor, it is commonly known as retail investing.

There is a myriad of issues with retail investing. First, seldom do advisors have the background, technology, or team to manage money directly or to adequately build efficient portfolios. Second, this advisor approach entails multiple fees; the advisor charges a fee, the fund or manager charges a fee, the broker dealer charges a fee, and clearing firms charge a fee. While the fee for advice may be simple and transparent, the other fees aren't (for more details go to our "What Everyone Should Know About Fee Only Advisors"). In addition to fees, there are other challenges that investors face that can impact long-term results, such as bond fund pricing disadvantages, spreads on trades, the negative impact of small investor herding, and phantom taxes.

This is why Linden Thomas & Co. and our team of professionals set out to build a firm -- both broker dealer and investment - that manages money directly. While we do give advice through our financial planners and advisors, our qualified clients are managed directly. This approach, known as institutional direct, gives us the ability to tailor each portfolio to the unique needs of each investor with a focus on maximizing long-term results. Unlike the approach taken by other firms, our earnings-focused approach is not only academic, but also efficient. Our results have a direct correlation to efficiency. Unfortunately, when investors engage retail advisors they often compromise when it comes to results. Therefore, for anyone with more than $1 million to invest, institutional direct is likely to be much more attractive. It is not just efficient, it's proven.

Remember, results are directly correlated to efficiency, and efficiency starts with earnings quality, direct ownership, and cost. This is the Linden Thomas & Co. way!

CLICK HERE to read our full disclaimers.

Awards & Recognitions

33 National Recognitions

By Barron, Forbes, and Financial Times.

Learn More ▸

Linden Thomas & Company was named one of Barron's Top 100 Independent Advisors in America 2022.

Learn More ▸

Linden Thomas & Company was named one of Financial Times Top 401 Retirement Advisors 2021.

Learn More ▸

Start saving money with your investments.