The importance of bonds in a portfolio cannot be overstated.

While historically bonds haven’t outperformed equities, they really shouldn’t be compared as an equivalent. Equities should be viewed as investments for long-term growth, while bonds are investments for cashflow. History has shown that over time, bonds and equities complement each other. While one cord can be broken, two cords are not easily severed.

Bonds are loans investors make to issuers in return for interest. There are many types of bonds and they all work slightly differently, but the basic components are:

Face (Par) Value

Maturity Date

Coupon

Price

Why Hold Bonds in Your Portfolio?

Some investors may think that bonds are not needed prior to retirement because they don’t need income and are focused on maximizing the growth of their portfolio. The truth is that building a bond portfolio prior to retirement establishes three distinct advantages. First, diversification among inversely related asset classes (i.e. when stock prices go down, bond prices usually go up). This helps stabilize the portfolio by spreading risk. Second, building buying power. Third, creating positive cashflow during down-markets.

During retirement, bonds are critical for generating income. Building a bond portfolio that creates strong net cashflow means that you don’t have to rely as much on other assets for your costs of living. During retirement bonds should serve your cashflow needs, while equities often help protect you against long-term inflation.

Two Ways to Invest in Bonds

Investors can gain exposure to bonds in two ways. The first way is by purchasing shares of pooled retail bond funds. These funds are best suited for small investors who don’t have enough capital to build a diversified bond portfolio using individual bonds. The benefit is that the small investor can get access to a diversified portfolio with a relatively small amount of capital.

However, retail bond funds contain some disadvantages as well such as:

- Expense ratios: Bond funds charge a fee called an expense ratio to help cover their operating cost and profit. This fee is not part of any fees your financial advisor may charge and many investors do not realize they are paying fund fees on top of their advisor fee.

- Trading Cost: Bond funds incur costs associated with buying and selling bonds, and these costs are passed on to investors and can add up to 1%-2% annually.

- Pricing Disadvantages: When investors buy into a bond fund, they are buying into a pre-existing portfolio of bonds that may have been attractive investments 5 or 10 years ago when the fund purchased them, but oftentimes no longer represent a good value to new investors today.

- Small Investor Herding Impact: In bond funds, all of the investors are pooled together and there is constant movement in and out of the fund. This creates the need for the fund managers to buy and sell frequently. During times of market volatility, this can cause the fund to incur substantially increased trading fees and spreads on trades.

The second way to invest in bonds is to buy them directly. This carries significant advantages over buying pooled bond funds but requires higher investment minimums in order to build a diversified portfolio. When buying bonds directly you have control over structuring cashflows, transparency into the holdings in your account, and elimination of herding impacts and expense ratios.

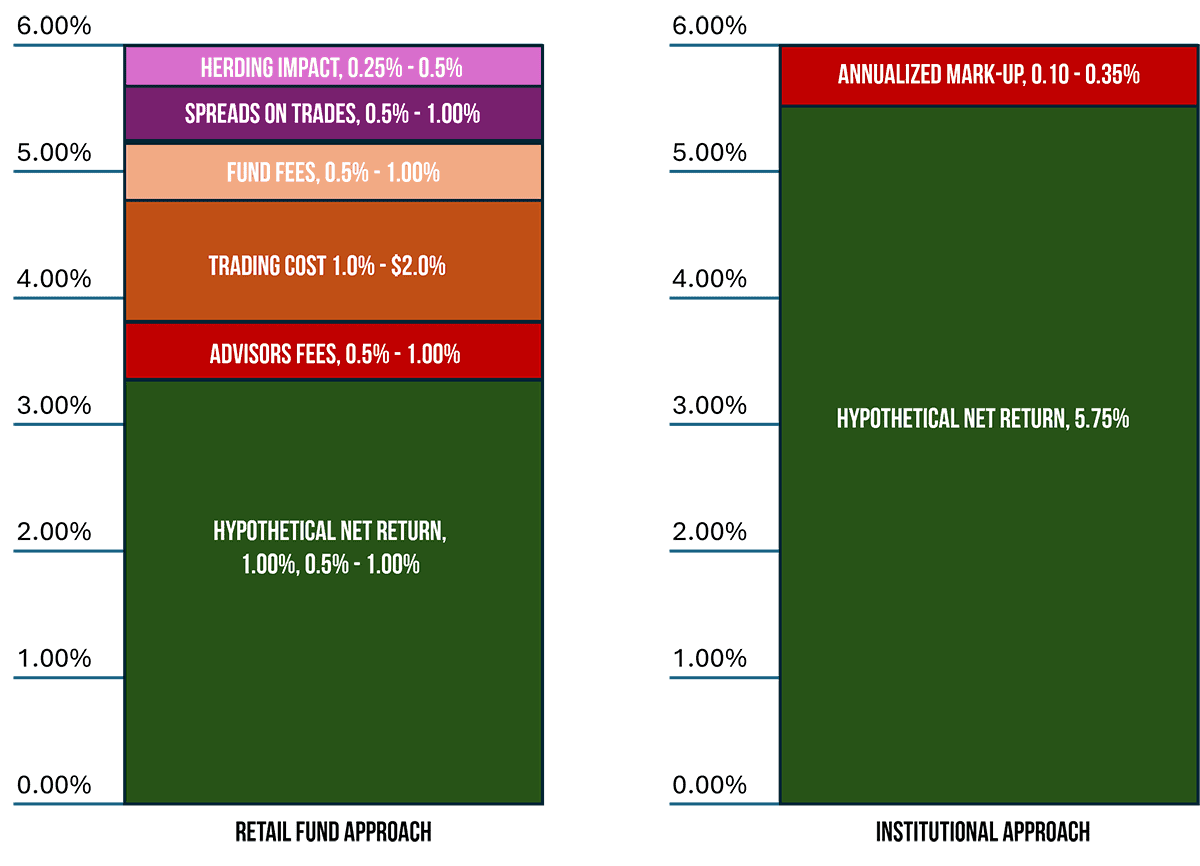

In the chart below you can see how removing the layers of fees found in pooled retail bond funds and have a dramatic impact on net yield. For affluent investors, this approach represents a substantial enhancement to the portfolio’s construction.

Our Unique Approach:

Institutional Direct

After 36 years in the industry and seeing firsthand how other investment advisor and their firms manage money, I believed the only way to achieve quality results was to build each portfolio directly with a focus on healthy companies, direct ownership, and controlling investor cost. Anything else would fall short of investors' expectations.

Pioneered by Stephen Thomas, Institutional Direct cuts out the high hidden costs of retail while giving investors access to tailored portfolio management with an institutional approach.

Hear from our clients

How We Got Here:

5 reasons why affluent investors choose our institutional approach

- A team of professionals dedicated to tailoring each portfolio to the client’s needs.

- Avoids the high and hidden costs found with retail investment advisors and their products.

- Direct ownership of holdings gives investors transparency and control.

- Tailored equity portfolios built for uncertain times by focusing on companies with high earnings standards.

- Yield focused fixed income portfolios are tailored to clients' income needs, maximizing pre-retirement compounding, and post-retirement cash flow.

A History of Linden Thomas & Company's Accolades*